Case Study: Vested

Mission

Vested was founded by two alumni from Circle, I joined as the third employee and founding designer. Our mission was to unlock the value of stock option compensation for employees in the tech sector, value that is frequently abandoned by employees who can’t afford to exercise:

Provide a unique dataset for valuing companies and the equity offers they make to new hires

Build tools and publish educational material for understanding and valuing equity earned by current employees

Provide liquidity through a market for private sales and stock option exercising financing when employees are departing

Role: Founding Designer

Responsible for product concept, user experience, visual design, research, brand, product copy, and growth experiments.

Responsive web product

$5.3M Raised

Illustration work by Matt Collins, Mark Grambau, and Vijay Verma

2019 – 2021

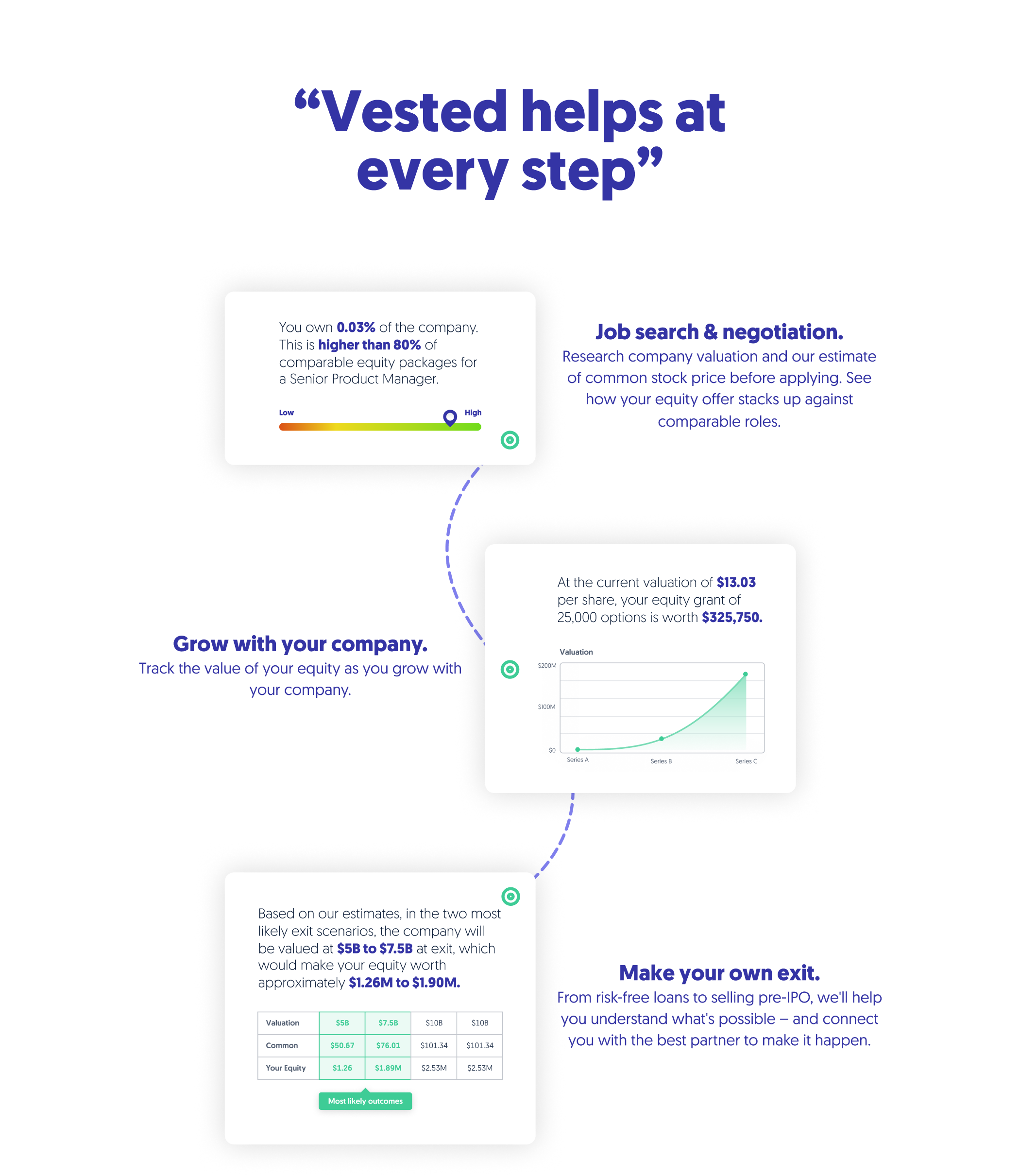

Strategy: build for each phase of employment

Our go to market plan was to ally ourselves directly with the employee, becoming a trusted and neutral party to provide education, tooling, and eventually a marketplace for their earned equity.

We saw oppotunity to onboard customers, win their trust, and eventually monetize at three stages of the employment lifecycle.

Interviewing

Employment offers including a stock option package are frequently hard to value and negotiate. By providing bespoke models and scraped data, we can offer tools to better evaluate total compensation.

Employed

Equity management software is primitive, and company valuations are often one-sided, leading to confusion about the true value of vested equity. We can build an impartial dashboard tool for better understanding this earned value.

Departure

Stock options are expensive and complicated to exercise, secondary markets for selling shares are fragmented and opaque. We can monetize this phase with exercise financing and an impartial market for secondary sales.

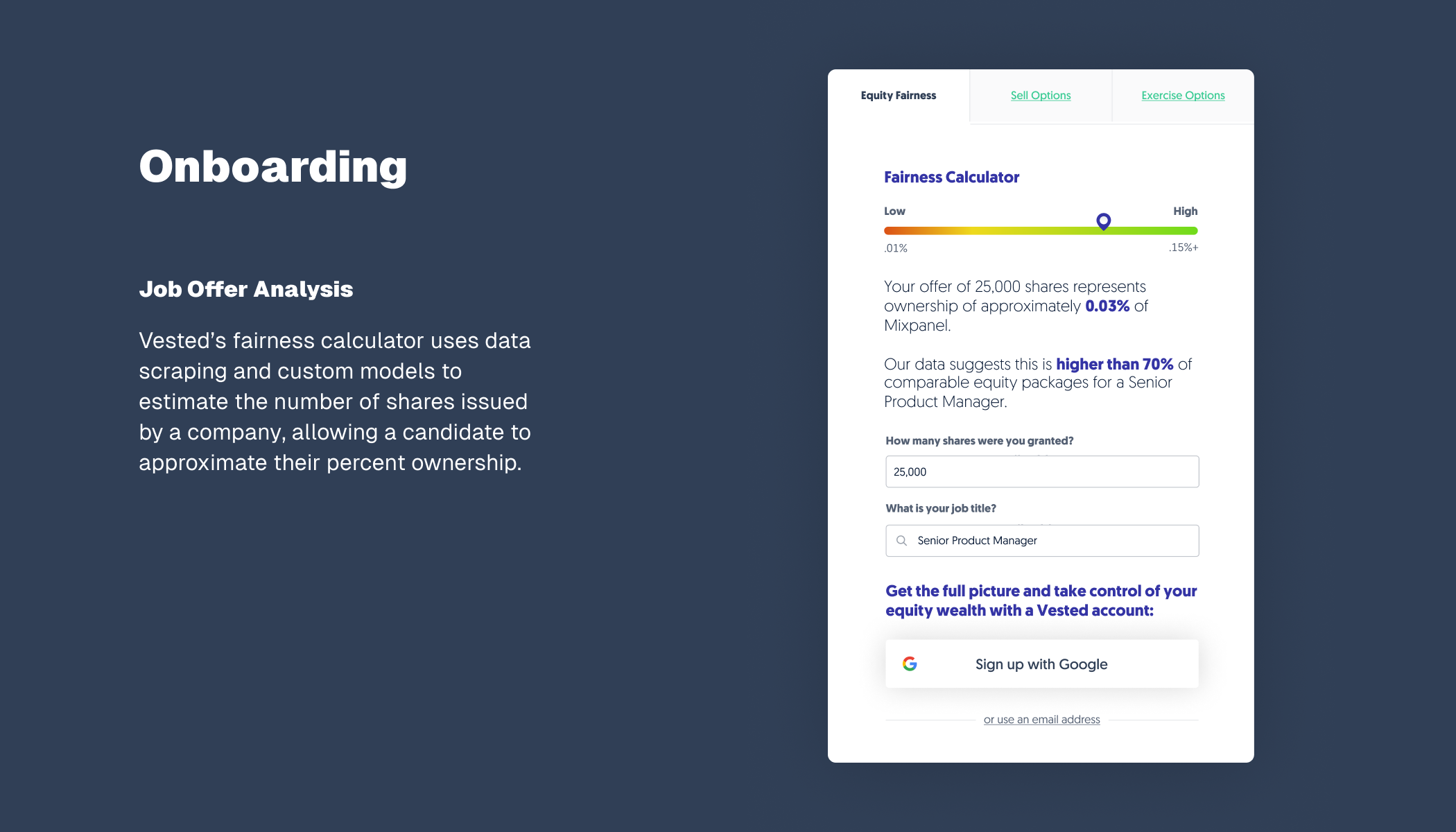

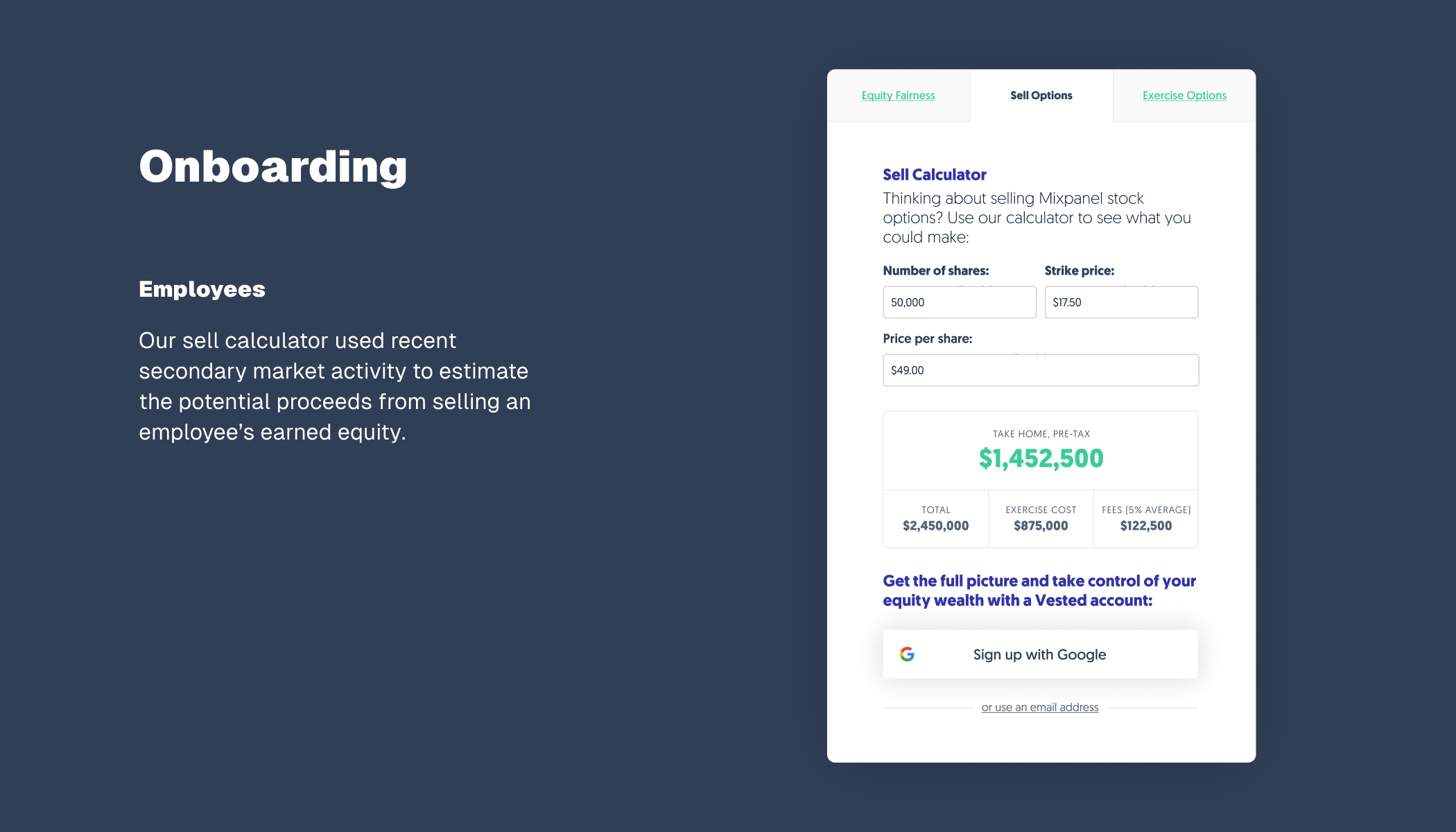

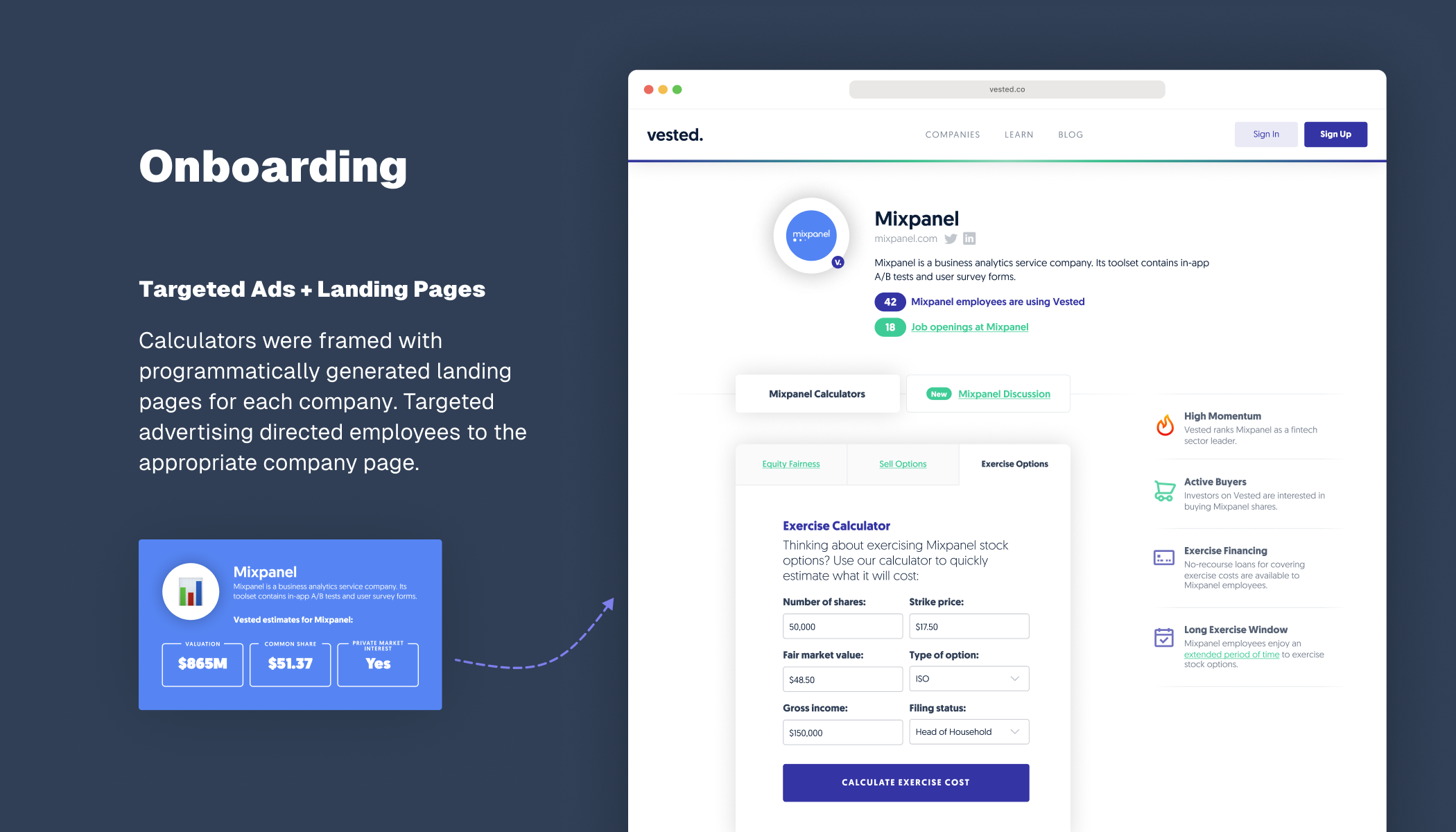

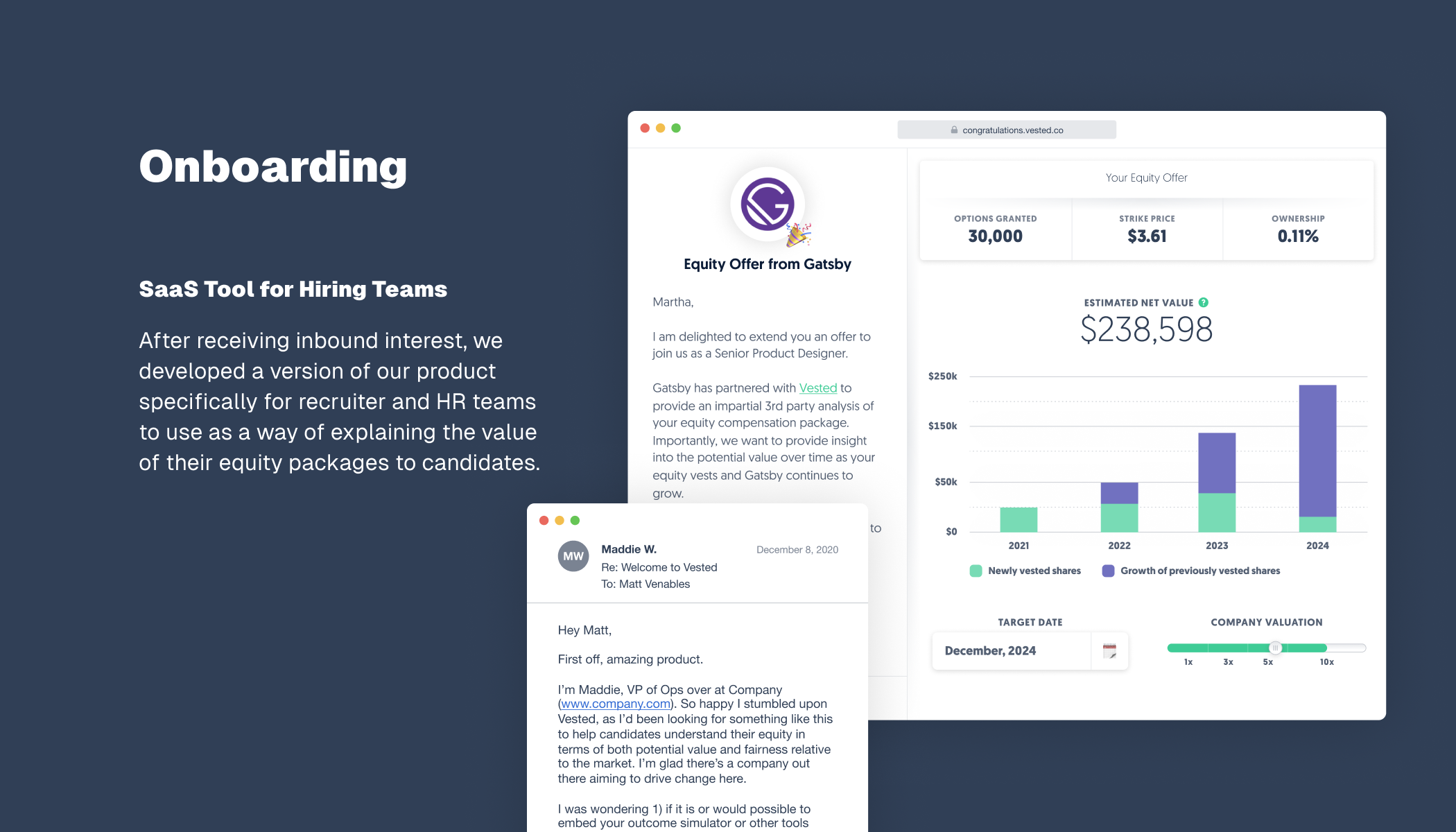

Customer Lifecycle: Onboarding

Reaching current and prospective tech employees via:

Equity compensation fairness

Sell & finance scenarios

Targeted advertising & landing pages

Selling into companies

What worked

The Equity Fairness calculator proved to be one of our most popular tools, consistently effective in generating signups.

Targeted advertising campaigns to employees via LinkedIn generated conversion rates approaching 10%, highly cost effective for acquiring users from specific companies.

Challenges

Attracting users at the job offer phase leaves a 2-5 year gap before they become revenue generating customers.

While our SaaS concept was highly popular with internal recruiting and HR teams looking to enhance their offer packages, we met uniform resistance from legal and finance teams.

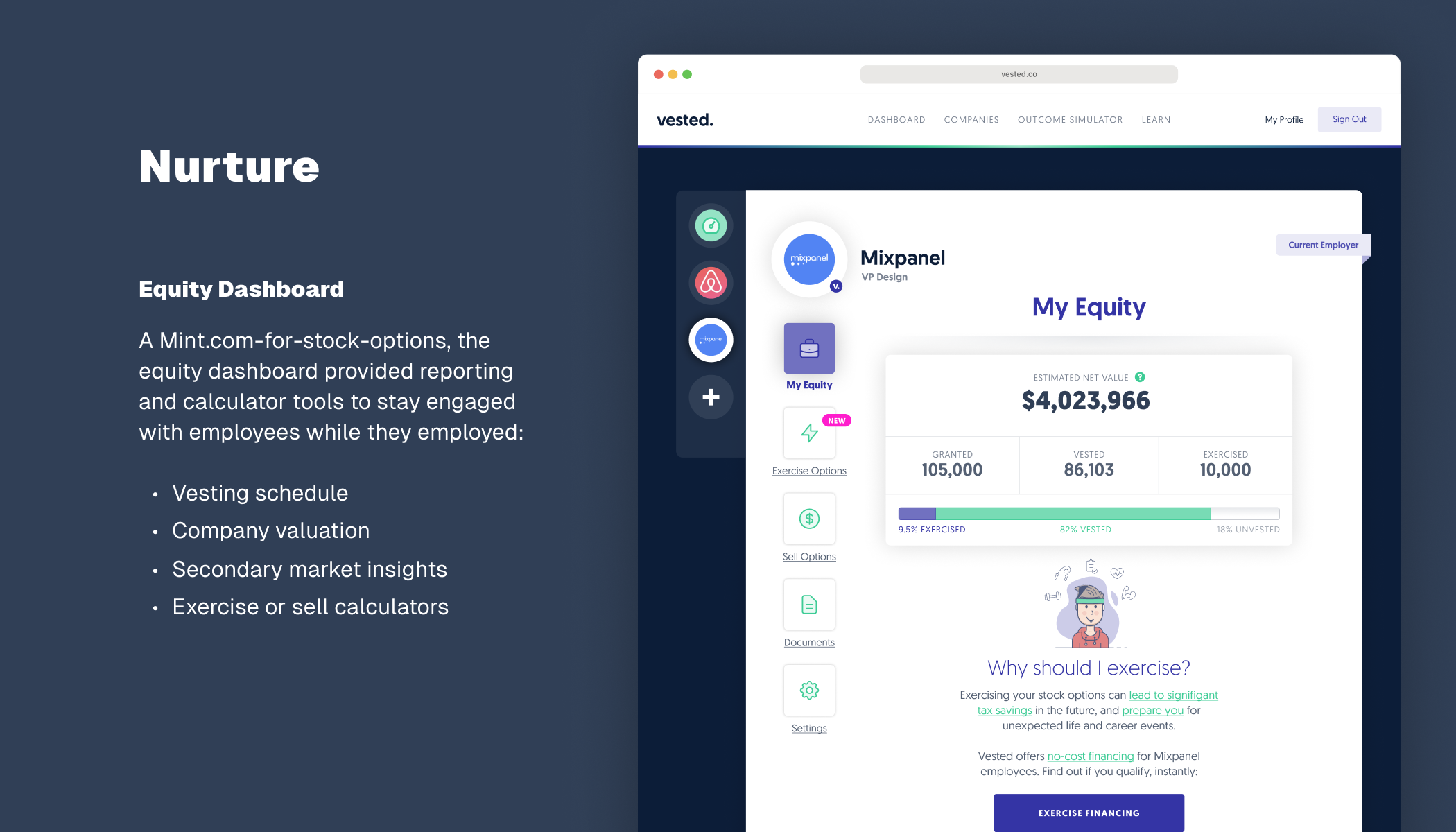

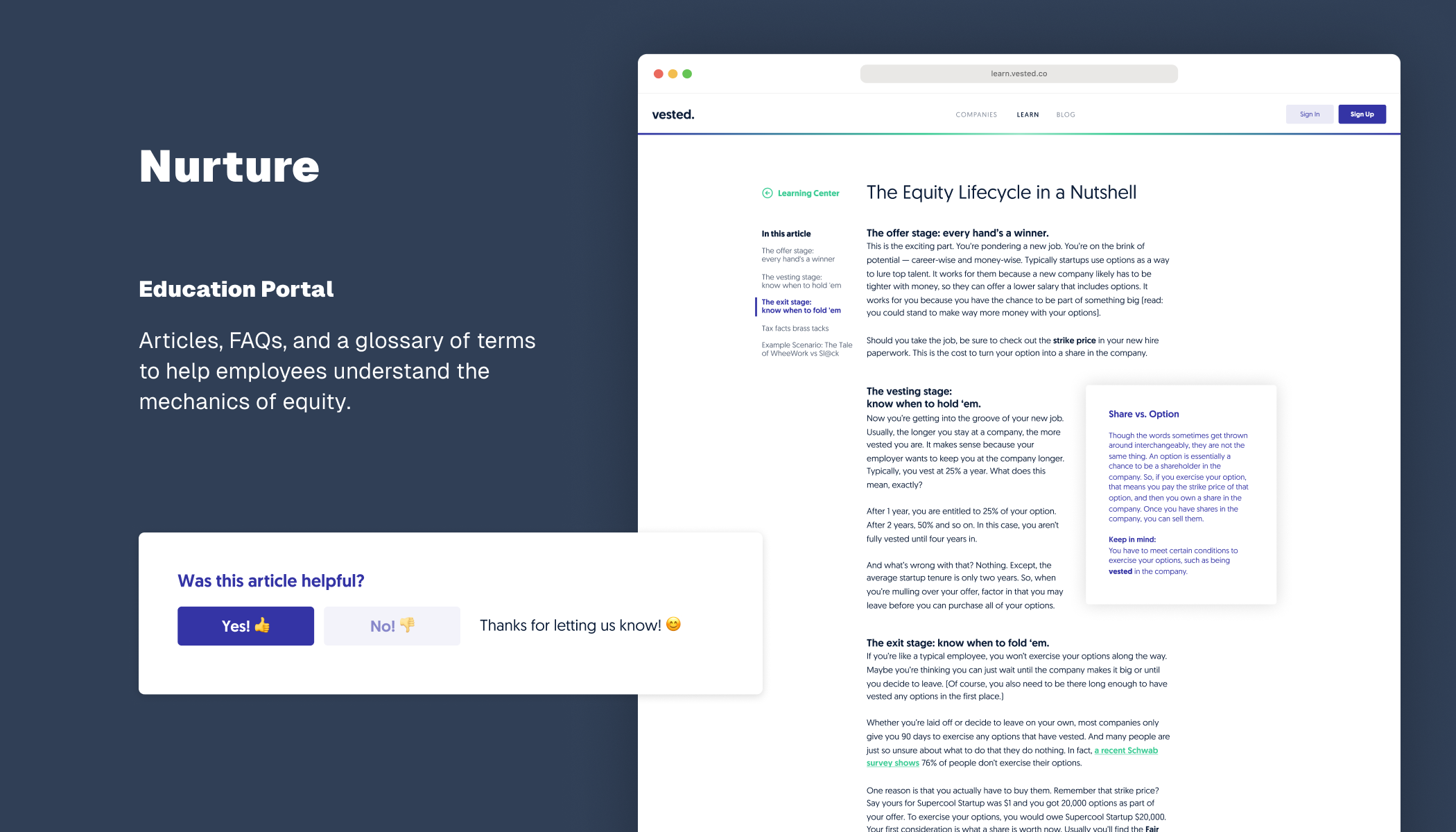

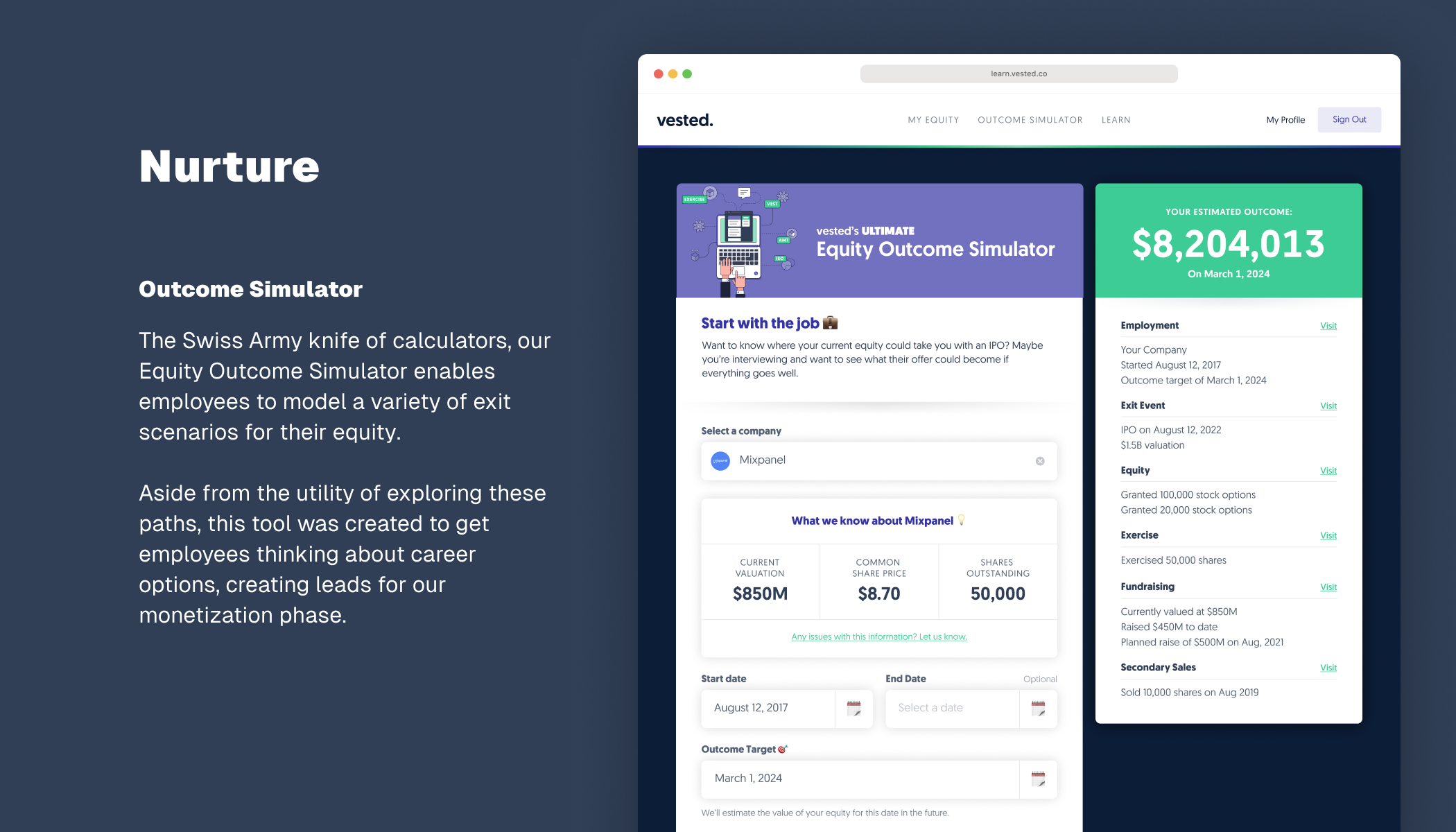

Customer Lifecycle: Nurture

Establishing trust with customers via:

A suite of tools for understanding their equity

Educational materials

Financial outcome simulator

What Worked

Dashboard tools were well received by users, and helped establish us as a neutral party, a beneficial context prior to entering into deals.

Calculator tools are very popular for daydreaming, and led to a marked increase in monetization leads.

Challenges

Financial education material is difficult for a lean team to produce, requiring a complex mix of financial/legal expertise, copywriting, and brand design. Scaling our content was demanding.

Equity management platforms (Carta, Shareworks) began to emulate our dashboard functionality.

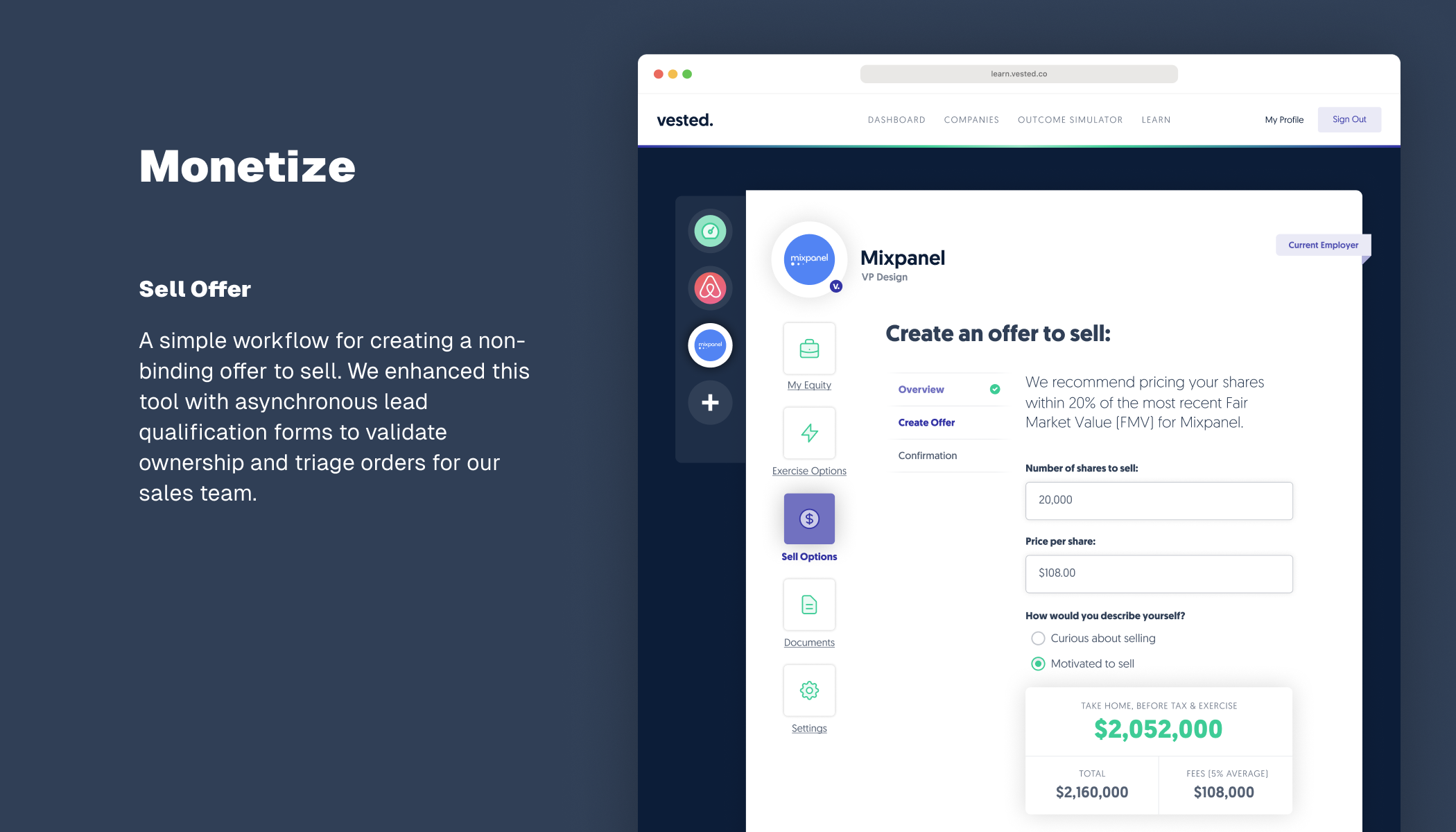

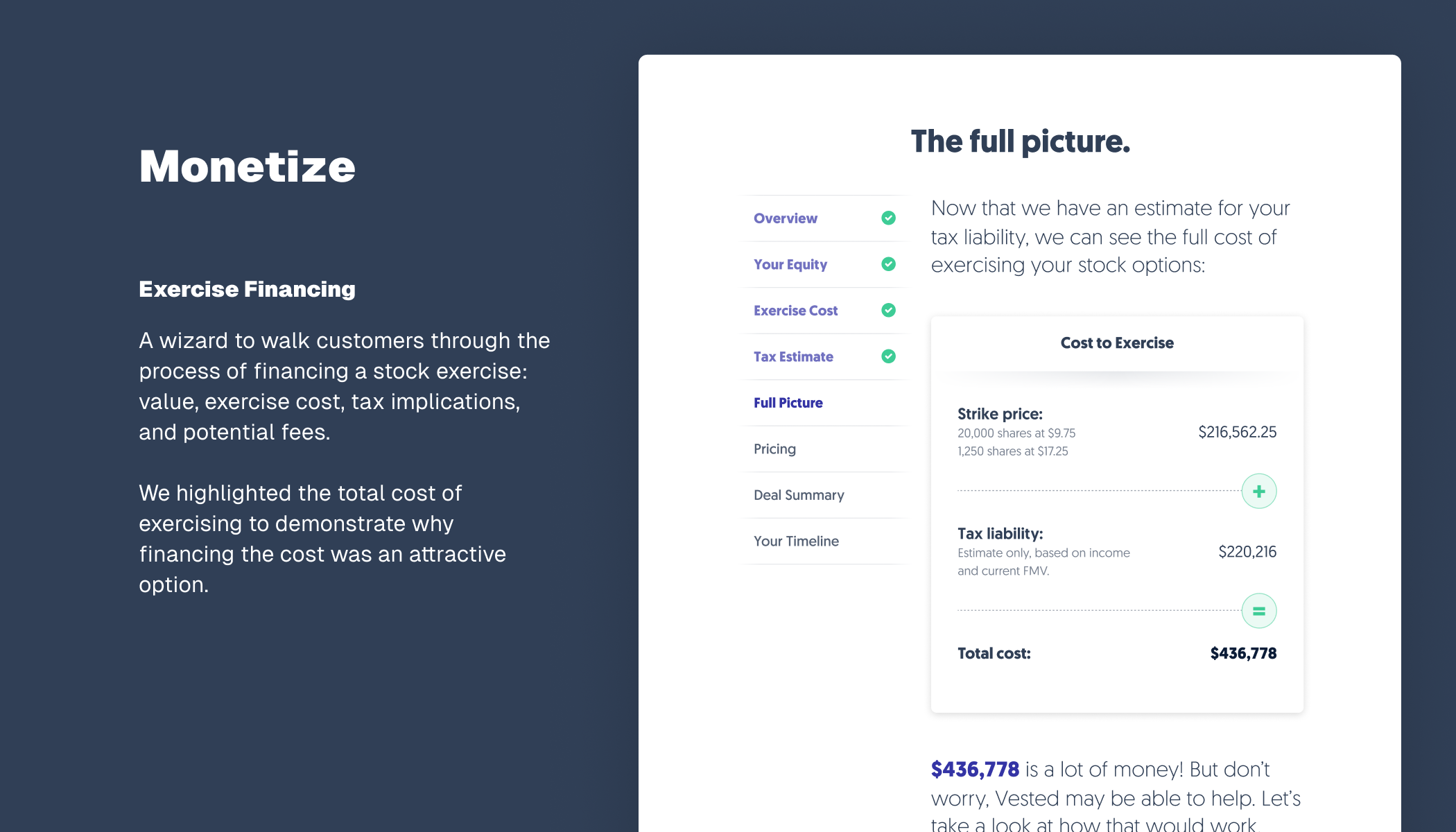

Customer Lifecycle: Monetization

Generating revenue via:

Surfacing realistic valuations

Brokering secondary market transactions

Providing exercise financing

What Worked

Surfacing realistic valuations and fees upfront helped users to better understand secondary market pricing and appropriately value their equity compensation.

Leading with the out-of-pocket costs associated with exercising stock options reduced skepticism of a financing product.

Motivated users, specifically those looking to leave a company without abandoning their stock options, were receptive to both products.

Challenges

Secondary markets for private companies are fickle, and the buyer generally holds the deal-making power. Difficult to serve most of our users or provide a predictable pricing model.

These transactions are ultimately a person-to-person deal, powered by emails and Docusign contracts. Hard to productize beyond the customer acquisition funnel.

Success with multiple employees of one company led to finance and legal teams taking action to reduce secondary transactions.

Conclusion

While we had success in building a popular tool for understanding and monitoring employee equity, as well as a proven funnel for attracting users to it, the individual nature of these deals prevented our end goal of fully automating the deal process.

Vested continues with a person-to-person deal process.